· account books · 13 min read

Best New Budget Planners of 2024: Organize Your Finances Today

Discover the top-rated budget planners of 2024, designed to help you take control of your finances. Whether you're looking for a monthly planner, envelope system, or digital tracker, we've got the perfect budget planner for you.

Organizing your finances can be a daunting task, but with the right tools, it can be a breeze. In this article, we'll introduce you to the best new budget planners of 2024. From monthly planners to envelope systems, we've got you covered. So whether you're looking to track your expenses, create a budget, or simply get your finances under control, read on to find the perfect budget planner for you.

Overview

PROS

- Undated design allows for flexible use and customization

- All-inclusive planning solution for budgeting, expense tracking, and bill organization

- Spacious layout provides ample room for notes, appointments, and additional expenses

- Durable cover and sturdy binding ensure longevity and protection

- Perfect for individuals and families seeking financial stability and control

CONS

- May require additional tracking tools for digital expenses, like a budgeting app

- Some users may prefer a more streamlined or compact format

Introducing the ultimate financial planning solution: the Budget Planner! This comprehensive notebook empowers you to take control of your finances and achieve monetary balance. Its undated format offers unparalleled flexibility, allowing you to start planning at any time without missing a beat.

Designed with convenience and practicality in mind, this budgeting powerhouse combines expense tracking, bill organization, and financial planning into one cohesive system. The spacious layout ensures ample writing space for jotting down essential notes, appointments, and unexpected expenses. Its durable cover and sturdy binding guarantee long-lasting use, making it your go-to budgeting companion for years to come.

PROS

- Comprehensive money-saving kit includes binder, cash envelopes, expense sheets, challenge tracker, and category labels.

- Cash envelope system promotes responsible budgeting and expense tracking.

- Durable construction ensures long-lasting use.

- Clear pockets in envelopes allow for easy identification of contents.

- Motivational challenge tracker helps you stay on track with your savings goals.

CONS

- Some users may find the binder's size bulky.

- Additional envelopes may be needed for more specific budgeting categories.

Introducing the Sooez New Budget Binder, the ultimate solution for transforming your financial habits. This comprehensive kit equips you with everything you need to take control of your finances and achieve your savings goals.

At the heart of this binder lies the proven cash envelope system. By allocating specific amounts to each category, you gain greater visibility and control over your expenses. The clear pockets in each envelope make it easy to identify the contents, ensuring you always know where your money is going. Additionally, expense sheets provide a detailed record of your transactions, while the challenge tracker keeps you motivated and accountable.

PROS

- Designed for budget-conscious individuals looking to gain control of their finances.

- Comprehensive layout includes sections for monthly budgeting, bill tracking, and financial planning.

- Convenient size (8'' x 10'') allows for easy portability and storage.

CONS

- Cover design may not appeal to all tastes.

- Might not be suitable for those with complex financial situations.

The Budget Planner is an invaluable tool for anyone looking to take charge of their financial future. Its well-organized layout and user-friendly design make it easy to track expenses, manage bills, and plan for financial success. Whether you're a seasoned budgeter or just starting out on your financial journey, this planner provides a comprehensive solution for achieving your financial goals.

One of the standout features of the Budget Planner is its versatility. It's suitable for individuals with varying financial needs and experience levels. The planner includes sections for monthly budgeting, bill tracking, and financial planning, ensuring that all aspects of your financial life are covered. Additionally, its compact size makes it easy to carry around, so you can stay on top of your finances wherever you go.

PROS

- 14-month undated planner for flexible budgeting

- Comprehensive expense and debt tracking sections

- Easy-to-use design with clear categories and prompts

- Bonus stickers for further customization and motivation

CONS

- May require additional space for extra notes or calculations

- Not suitable for those seeking a digital budgeting solution

Introducing the Monthly Budget Planner – your all-in-one solution for financial empowerment. This undated planner empowers you to take control of your finances with its comprehensive 14-month layout. Effortlessly track your expenses, manage debt, and stay organized with its clear categories and prompts. Our commitment to quality extends to every element, ensuring a durable and practical tool that will accompany you on your budgeting journey.

The Monthly Budget Planner goes beyond mere tracking. It's a financial companion that inspires mindful spending and debt reduction. Its thoughtful design accommodates a wide range of budgeting styles, making it adaptable to your unique needs. Whether you're a seasoned budgeter or just starting out, this planner will guide you towards financial success. Don't settle for scattered spreadsheets or confusing apps – invest in the Monthly Budget Planner today and unlock the key to a brighter financial future!

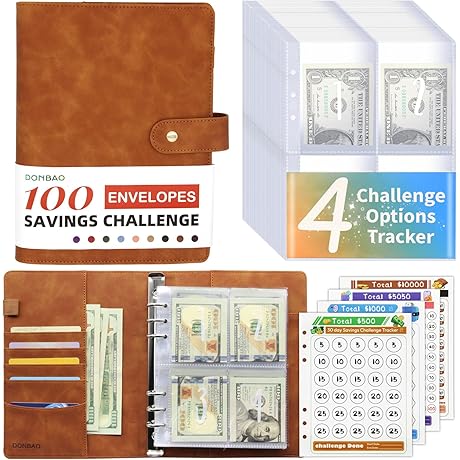

PROS

- Comprehensive binder includes everything you need to start saving money

- A5 size is perfect for carrying around in your bag or purse

- Includes 2024 savings challenges planner book to help you stay on track

- Envelopes and challenge tracker help you visualize your progress

- Perfect for individuals or families looking to get their finances in order

CONS

- The envelopes are not reusable

- The binder may be too small for some people's needs

If you're looking for a way to get your finances in order, the 100 Envelopes Money Saving Challenge Binder is a great option. This comprehensive binder includes everything you need to start saving money, including 100 envelopes, a challenge tracker, and a 2024 savings challenges planner book. The A5 size is perfect for carrying around in your bag or purse, and the envelopes and challenge tracker help you visualize your progress.

The 100 Envelopes Money Saving Challenge Binder is a great way to stay motivated and on track with your savings goals. The envelopes help you to separate your money into different categories, such as bills, groceries, and entertainment. The challenge tracker helps you to track your progress and stay motivated. And the 2024 savings challenges planner book provides you with a variety of challenges to help you save even more money.

PROS

- 100gsm paper ensures durability and minimises ink bleed

- Undated design allows for flexible budgeting and customisation

- Expense tracker offers comprehensive budgeting and financial management tools

- Silvery cover adds a touch of sophistication and style

- Compact A5 size makes it easy to carry and use anywhere

CONS

- Some users may find the cover to be too delicate or prone to scratches

- Expanding to add additional categories might not be possible due to the limited page count

- User feedback suggests that the small size can be restrictive for tracking complex financial data

This elegantly designed budget planner stands out for its well-thought-out features and high-quality construction. Crafted with durable 100gsm paper, this organiser is designed to withstand the rigors of daily use. Its undated format empowers you to begin budgeting at any time without worrying about wasted space. Additionally, the comprehensive expense tracker provides an efficient way to monitor your spending habits and identify areas for optimisation.

The eye-catching silvery cover adds a touch of sophistication to your financial planning. However, some users have expressed concerns about its durability. The compact A5 size is perfect for carrying in a purse or briefcase, making it an excellent choice for on-the-go budgeting. However, individuals tracking complex financial data may find the limited space restrictive. Nevertheless, this budget planner offers an excellent balance of functionality and style, making it a valuable tool for anyone looking to take control of their finances.

PROS

- Control Spending. Stay Organized. Achieve Financial Goals.

- Undated 12-Month Format for Flexible Budgeting

CONS

- May Require Additional Planning for Detailed Tracking

This new budget planner is a game-changer for your financial journey. Its undated 12-month format gives you the flexibility to start budgeting anytime. Each month's layout includes ample space for tracking expenses, bills, and notes, ensuring a comprehensive overview of your cash flow. Track your spending habits and identify areas for improvement with ease. Embark on a path to financial freedom and live the life you deserve.

While it's a great tool for basic budgeting, those seeking more granular detail may need to supplement it with additional spreadsheets or apps. Nevertheless, for anyone looking to take control of their finances and achieve their financial goals, this budget planner is an indispensable companion. Start budgeting smarter today and experience the transformative power of financial freedom.

PROS

- Easy and funny way to save money

- Perfect for beginners or experienced savers

- Includes everything you need to get started, including 100 envelopes and a budget planner

- Makes saving money fun and rewarding

CONS

- May require some time for initial setup

The 100 Envelopes Money Saving Challenge Budget Planner is a simple and effective way to reach your financial goals. With its easy-to-follow instructions and helpful tips, you'll be able to save $5,050 in just 100 days. And because it's so much fun, you'll actually look forward to saving money!

The kit comes with everything you need to get started, including 100 envelopes, a budget planner, and stickers. The envelopes are divided into different categories, such as "bills," "groceries," and "fun money," so you can easily track your spending. The budget planner helps you set realistic savings goals and track your progress.

PROS

- Comprehensive expense and bill tracking for accurate financial management

- Undated format allows for flexibility and customization to suit your needs

CONS

- Budgeting requires discipline and consistency, which may not be suitable for everyone

Introducing the indispensable 2024 Budget Planner, your ultimate financial companion designed to help you take control of your money! This undated monthly budget book empowers you with a comprehensive expense and bill tracking system, providing a clear overview of your financial habits. The flexibility of its undated format allows you to start planning anytime, making it a suitable choice for those seeking a customizable budgeting solution.

With this planner, you can effortlessly track your expenses, bills, and savings in one organized space. Its intuitive design guides you through the budgeting process, making it accessible for both experienced and novice budgeters. Whether you're looking to optimize your spending, reduce unnecessary expenses, or plan for future financial goals, this budget book offers a comprehensive solution to help you achieve your objectives. Embrace financial freedom and make informed decisions with our must-have 2024 Budget Planner today!

PROS

- - Save consistently with our 52-week savings challenge.

- - Keep your finances organized with our convenient money binder.

- - Durable and reusable binder for years of savings success.

CONS

- - Not suitable for extreme budgeting needs.

- - Envelopes may not be suitable for storing large amounts of cash.

Introducing our innovative New Budget Binder, designed to revolutionize your savings strategy! This comprehensive binder empowers you with a structured 52-week savings challenge, guiding you towards financial stability. The accompanying money binder provides a secure and organized space to manage your finances, eliminating the hassle of scattered receipts and loose change.

Crafted with exceptional durability, our New Budget Binder is built to withstand the rigors of daily use. Its reusable nature ensures that you can embark on multiple savings challenges without the need for costly replacements. The included 100 envelopes offer ample storage for your savings, allowing you to allocate funds for various goals. Whether you're saving for a down payment, a dream vacation, or simply building an emergency fund, our New Budget Binder provides the perfect solution.

In this article, we've introduced you to the best new budget planners of 2024. We've covered a wide range of planners, from monthly planners to envelope systems to digital trackers. So whether you're looking to track your expenses, create a budget, or simply get your finances under control, there's a budget planner out there that's perfect for you. So what are you waiting for? Get started today and take control of your finances!

Frequently Asked Questions

What are the best new budget planners of 2024?

The best new budget planners of 2024 include the Budget Planner - Monthly Budget Book with Expense Tracker Notebook, the Sooez Budget Binder with Money Saving Challenge, and the Budget Planner - Monthly Budget Book with Bill Tracker.

What are the benefits of using a budget planner?

Using a budget planner can help you track your expenses, create a budget, and get your finances under control. It can also help you save money and reach your financial goals.

How do I choose the right budget planner for me?

When choosing a budget planner, consider your individual needs and preferences. If you want to track your expenses, look for a planner with a lot of space for notes. If you want to create a budget, look for a planner with pre-made templates. And if you want to get your finances under control, look for a planner with features like debt trackers and savings trackers.

How do I use a budget planner?

To use a budget planner, simply start by tracking your expenses. Once you have a good understanding of where your money is going, you can start to create a budget. And once you have a budget, you can start to work towards your financial goals.

What are some tips for staying on track with my budget?

To stay on track with your budget, set realistic goals, track your progress regularly, and make adjustments as needed. You should also be prepared to make sacrifices and be patient.